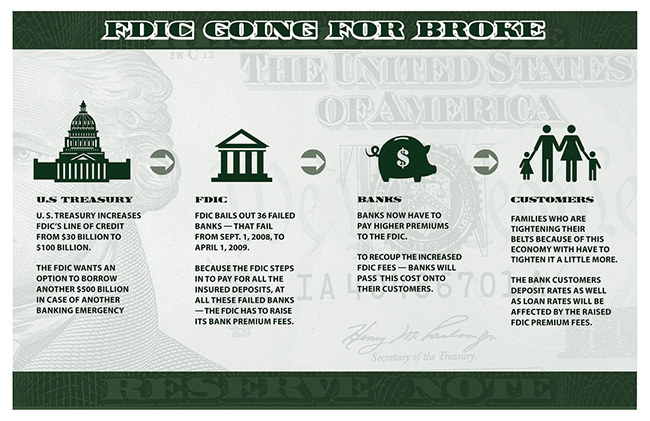

I was wondering recently if the FDIC bailing out of banks would have an affect on my personal bank account. I foolishly believed that it wouldn't. But as I did some basic research on the matter I discovered that, Yes it will impact me. The FDIC's bailing out of banks is going to affect everyone who has a savings account or a loan through their bank. I quickly put together a simple information graphic (above) showing you the link from the U.S Treasury to the bank customer.

U.S. Treasury increases FDIC's line of credit from $30 billion to $100 billion. The FDIC wants an option to borrow another $500 billion in case of another banking emergency.

FDIC bails out 36 failed banks - that fail from September 1, 2008 to April 1, 2009. Because the FDIC steps in to pay for all the insured deposits, at all these failed banks, the FDIC Has to raise its bank premium fees.

Banks now have to pay higher premiums to the FDIC. To recoup the increased FDIC fees - banks will pass this cost onto their customers.

Families who are tightening their belts because of the economy with have to tighten it a little more. Bank customers deposit rates as well as loan rates will be affected by the raised FDIC premium fees.

Illustration Paulo Pereira

No comments:

Post a Comment